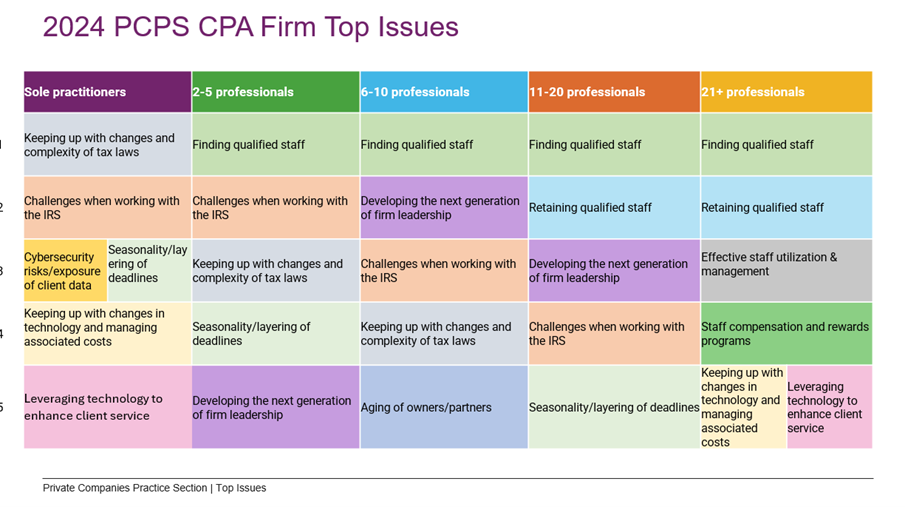

LAS VEGAS (June 6, 2024) – Finding qualified staff is the top issue for all categories of accounting firms except sole practitioners, according to a biennial survey by the American Institute of CPAs’ firm practice management section.

A second leading issue – for all but the largest firms (21 professionals or more) – is service problems with the Internal Revenue Service, the Private Companies Practice Section (PCPS) CPA Firm Top Issues Survey found. That concern was the top response among firms the last time the survey was conducted in 2022, a period when the IRS was buried under backlogs due to the pandemic.

Talent issues stretch beyond staff recruitment, the survey found. The two largest firm categories (11-20 professionals and 21 or more professionals) listed “retaining qualified staff” as their No. 2 issue. Small to midsize firms listed “developing the next generation of firm leaders” as a top 5 concern or higher.

Results of the survey are segmented by firm size, since the perspectives of a small-firm CPA are often substantially different from those of a practitioner employed by a large firm. Despite that, the firm segment lists often reveal trends across categories. Survey respondents are asked to rank the impact of a host of issues on a 1-5 scale, with one being “minimal” and five being “extreme.”

Among other findings of the survey:

“Keeping up with changes and complexity of tax laws” is a significant issue for sole practitioners through midsize firms.

The largest firms named “Effective staff utilization and management” and “Staff compensation and reward programs” among their top five concerns

Sole practitioners and the largest firms were most concerned with the impact of technology, with both categories naming “Keeping up with changes in technology and managing associated costs” and “Leveraging technology to enhance client service” as top five concerns.

Beyond current concerns, survey respondents were asked to rank issues expected to have the greatest impact on firm practice operations over the next five years. Staffing, contending with emerging technologies and changes in the regulatory environment were the most common issues across categories.

“The interplay between talent and technology is interesting, since we know that innovation improves productivity,” said Lisa Simpson, CPA, vice president of firm services for AICPA & CIMA. “Firms need strategies to address both of these core issues, particularly as the impact of artificial intelligence and digital transformation become clearer.”

Topline results of the CPA Firm Top Issues Survey were announced at AICPA & CIMA ENGAGE 2024, one of the world’s leading conferences devoted to accounting and finance. To learn more about PCPS and its resources – including its award-winning “Transforming Your Business Model” portfolio – please visit the section’s webpage.

Survey Methodology

The PCPS CPA Firm Top Issues Survey was conducted online from April 22 to May 27, 2024. The 667 respondents represent a mix of practice types and firm sizes, from sole practitioners to large firms with 21 or more professionals. A full commentary on survey results will be available later this summer.