Social Security and Your Future

As recent reports suggest that Social Security benefits may not be guaranteed for the younger generations, many of us wonder if these benefits will be available when we retire. This uncertainty has led many to question whether their financial plans will be sufficient, possibly requiring them to work longer than originally planned. Regardless of these plans, however, individuals are still required to enroll in Medicare at a certain age to avoid penalties.

To address these concerns, the Government Performance and Accountability Committee (GPAC) invited Ms. Trisha Mentzer, a Social Insurance Specialist from the Social Security Administration’s Office of Communications, to speak at its virtual fall meeting in September 2024. During her presentation, Ms. Mentzer provided an overview of Social Security services and benefits, clarifying key issues and addressing questions on the future of the programs.

Social Security and Its Reach

Social Security impacts the lives of nearly all Americans in some way. Ms. Mentzer encourages everyone to create a my Social Security (mySSA) online account with the Social Security Administration (SSA). This free tool offers customized resources for everyone, regardless of whether they are currently receiving benefits. Through this account, individuals can check the status of applications, review earnings history, estimate future benefits, or even request a replacement Social Security card (in some states). Ms. Mentzer highlighted the SSA’s commitment to a user-friendly website to reduce the complexity often associated with these processes.

Beyond Retirement: Social Security’s Broad Scope

When we think of Social Security, retirement benefits usually come to mind. However, the SSA also provides a range of other benefits, including Disability, Survivor, Supplemental Security Income, and Medicare.

This Insight offers a brief overview of three of these benefits: Disability, Retirement, and Medicare.

How to Apply for Social Security Benefits

For Disability benefits, the SSA recommends that you apply as soon as possible; and for Retirement benefits, you can apply as early as four months prior to when you want them to begin. The SSA provides several options for applying:

Online Application: You may apply online for Disability, Retirement, or Medicare benefits. If you have a disability and are at least 62 but have not yet reached full retirement age, you can apply for both Disability and Retirement benefits with a single application. Note that online filing is currently unavailable for Survivor or Spousal benefits.

Phone or In-Person Appointment: You can also schedule a telephone or in-office appointment by calling 1-800-772-1213, 8 a.m. – 7 p.m. Monday through Friday. However, claims for Child and Survivor benefits must be completed either by phone or in person.

Disability Benefits

For those who can no longer work due to a disability, the SSA provides Disability benefits to replace some of the lost income. These benefits offer modest financial support to individuals with disabilities, including both workers and veterans and their dependents. Because the disability application process involves many variables and unique situations, here is a general overview of the disability application process:

Eligibility: To qualify for SSA’s Disability benefits, you must meet their definition of disability. This means being unable to engage in substantial gainful activity (SGA) due to a medically determined physical or mental impairment that is either expected to last at least 12 months or result in death.

Application Process: According to Ms. Mentzer, the SSA expedites claims for individuals with a 100 percent VA disability. However, it can take six to eight months for the SSA to process a Disability application. Ms. Mentzer advises applying as soon as your disability develops to start the process early. Additionally, she noted that providing sufficient information at the time of application can help expedite processing.

Medical Review: After submitting your application, it will be forwarded to the Disability Determination Services (DDS) agency in your state. The DDS will contact medical providers to obtain necessary medical records. If additional information is needed to make a determination, the DDS will follow up with you.

SSA Decision: Once a determination is made, SSA will send a letter informing you of the decision. If approved, the letter will outline your benefit amount, payment dates, reporting responsibilities. If denied, SSA will provide an explanation and instructions on how to appeal if you disagree with the decision.

Retirement - How Social Security Administration Determines Your Benefit

The Federal Insurance Contributions Act (FICA) taxes fund Social Security programs, FICA, which may also appear on your paycheck as OASDI (Old-Age, Survivors, and Disability) or simply as Social Security, is a federal payroll tax. It is deducted from workers’ paychecks and matched by employers.

Retirement Benefits are based on earnings. The calculation involves:

Wage Adjustment: Your past wages are adjusted to account for changes in wage levels over time.

Average Earnings: The monthly average of your highest 35 years of earnings is calculated.

Final Calculation: This produces your “average indexed monthly earnings”.

Full Retirement Age and Benefits Reduction

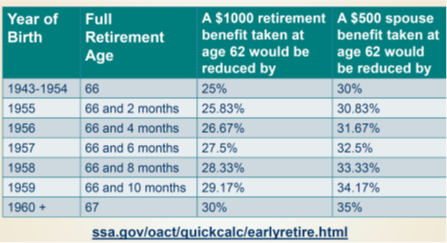

Your Full retirement age (FRA) depends on your birth year. If you begin receiving benefits before reaching your FRA, your benefit will be reduced. For example, if your FSA is 66 but you start claiming benefits at age 62, your monthly benefits will be reduced by 25 percent. The chart below outlines benefit reductions if collecting benefits before reaching full retirement age:

Benefits Charts by Age

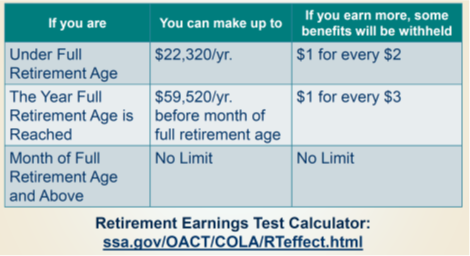

If you wait until your FRA starts receiving benefit, you will receive the full amount with no reductions. At this age, you may also work without any reduction in benefits, as there is no income limit once you reach FRA. However, if you begin collecting benefits before your FRA and continue to work, your benefits may be reduced depending on your earnings. SSA imposes an income limit for those under FRA and may withhold some benefits if you exceed that limit to prevent overpayments. The chart below outlines income limits and benefit reductions for 2024:

Working While Receiving Benefits

Deferring Social Security Retirement Benefits

You may choose to defer your Social Security retirement benefits beyond your FRA; however, you must start receiving benefits by age 70. According to Ms. Mentzer, there is no additional benefits to delaying past age 70 – at this point, deferring further simply results in lost income you’re entitled to receive.

What Counts as Income for SSA

For income purposes, the SSA only considers earnings from wages, self-employment, or 1099 income. Other sources, such as Social Security benefits, veterans or unemployment benefits, pensions, investment income, or gifts from family and friends, are not included in SSA’s income calculations.

When to Start Receiving Retirement Benefits

Determining the best age to start receiving retirement benefits is a personal decision that depends on individual situations. Ms. Mentzer notes that many financial experts suggest you may need 70% to 80% of your pre-retirement income for a comfortable retirement.

Your monthly Social Security benefit amount varies based on the age you begin receiving benefits – the longer you wait (up to age 70), the higher your benefit. Once you start receiving benefits, that amount is generally locked in. However, SSA provides a one-time option to withdraw your application within 12 months of starting benefits, allowing you to repay all payments received and reset your start date if your circumstances change.

Will I Pay Federal Taxes on my Social Security Benefits?

According to Ms. Mentzer, under IRS rules for 2024, no one pays federal taxes on more than 85 percent of their Social Security benefits. Each year, the SSA issues a 1099 form detailing the total benefits received, and it is the individual’s responsibility to determine the taxes owed on these benefits. Although federal tax withholding from Social Security is optional, you may request it when you first apply for benefits or later by submitting a W-4 form to the SSA. You can choose withholding rates of 7%, 10%, 12%, or 22% of your monthly benefit. The SSA will deduct the selected amount before issuing your payment, and the total withheld will be shown on your 1099 statement.

Medicare Eligibility and Components

While full retirement age varies, Medicare eligibility typically begins at age 65. However, you may qualify earlier under certain conditions, such as:

Receiving Social Security Disability Insurance (SSDI) for over 24 months,

Having a diagnosis of ALS (amyotrophic lateral sclerosis),

Experiencing end-stage renal disease (kidney failure).

Ms. Mentzer explained that Medicare has multiple parts:

Original Medicare includes Part A (Hospital Insurance) and Part B (Medical Insurance), both managed by SSA.

Part D (Prescription Drug Coverage) can be added to Original Medicare, along with optional Supplemental Insurance.

Medicare Advantage (Part C) is an alternative to Original Medicare, combining Parts A & B and often includes Part D, as along with additional benefits such as vision, hearing, dental coverage.

There are three main enrollment periods for Medicare:

Initial Enrollment Period: Begins three months before your 65th birthday and ends three months after your birthday month.

General Enrollment period: Runs annually from January 1 to March 31.

Special Enrollment period: If you are 65 or older and covered by group health insurance through your employer (or your spouse’s employer), you are not required to enrollment in Part B immediately or pay the premium. However, once this group coverage ends, you must contact the SSA to enroll in Part B promptly to avoid late enrollment penalties.

Ms. Mentzer noted that SSA employees primarily assist with Medicare Parts A and B but are not Medicare experts. For comprehensive Medicare information, the SSA strongly encourages participants to visit www.Medicare.gov.

The Future of Social Security Funds

According to Ms. Mentzer, the combined Social Security trust funds – Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) – are projected to pay full benefits on time until 2035, an extension of one year beyond 2023 projections. In the past, Congress has made changes to prevent the trust funds from depleting entirely. If Congress does not act before 2035, the trust funds are projected to cover approximately 83 percent of scheduled benefits.

The Future of Social Security is influenced by several demographic factors, such as birth rates. The United States has experienced significant demographic shifts over time. For example, in 1920, the average fertility rate was 3.3 births per woman, but it declined during the Great Depression and surged post-WWII with the Baby Boomer Generation. Today, a large number of Boomers are retiring, which has shifted the ratio of workers to beneficiaries. In 1960, there were five workers per Social Security recipient; today, that ratio is about 2.7 workers for each Social Security recipient.

Insights from the 2024 OASDI Trustees Report

The 2024 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds provides a comprehensive outlook on Social Security’s financial status. The report projects that by 2035, program costs will rise to the point where tax revenues will cover 83 percent of scheduled benefits. This increase in cost is primarily due to population aging, driven not by extended life spans but by declining birth rates – from about three to two children per woman.

The report further notes that after 2035, this shortfall is expected to remain stable, and addressing the gap with adjustments to taxes or benefits could potentially restore Social Security’s solvency, ensuring sustainability for the foreseeable future.

***NOTE: Ms. Mentzer emphasized that Social Security information is subject to change due to new laws and policy updates. To be informed, the SSA encourages individuals to regularly visit their official website at www.ssa.gov.

Links and Resources

Social Security Administration

Medicare Information

Stephen C. Goss, Chief Actuary, Social Security Administration, The 2024 Annual Report of the Board of Trustees of the Federal Old-Age and Survivors Insurance and Federal Disability Insurance Trust Funds, May 7, 2024 .