A comprehensive retirement solution for CPAs, created by CPAs

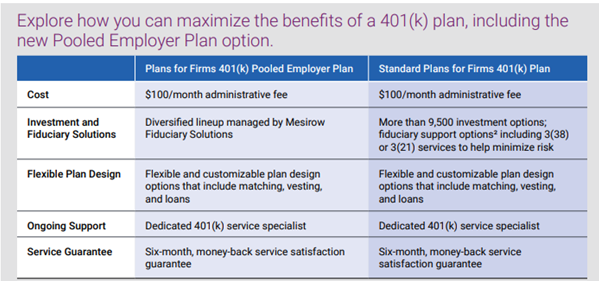

The AICPA 401(k) Plans for Firms program makes retirement benefits a reality for your firm. And now you have two options, either the standard Plans for Firms 401(k) Plan or the Plans for Firms PEP (Pooled Employer Plan).

The AICPA 401(k) Plans for Firms program allows small, mid-sized, and sole practitioner firms to:

Maximize partner savings for tomorrow

Reduce tax liability

Attract and retain top talent

Access exceptional $100/month plans exclusively for AICPA firm members with 1-50 employees

Select from over 9,500 investment options including:

The AICPA 401(k) Plan for Firms Member Retirement program has been designed around the needs of AICPA members in firms with 1 to 50 employees. For AICPA members in business and industry or in firms with greater than 50 employees, these benefits may not apply. Please consult with a sales specialist to learn more. The consultation with a local retirement specialist is available in most major markets.

Retirement Programs Made Easy

It's never too early to start planning your financial future or to get into the right program, especially when it's this simple.

We understand that choosing the right program can be overwhelming, which is why we've done the work for you by creating options that works for everyone.

This program is administered and offered in conjunction with Paychex Retirement Services, the country's largest 401(k) recordkeeper. With over 90,000 plans, they bring a proven record of outstanding service for firms like yours, extraordinary value, and unparalleled support for the CPA community.

Your Firm Will Enjoy a Long List of Plan Benefits

Why a 401(k) is the Smart Choice for EVERYONE

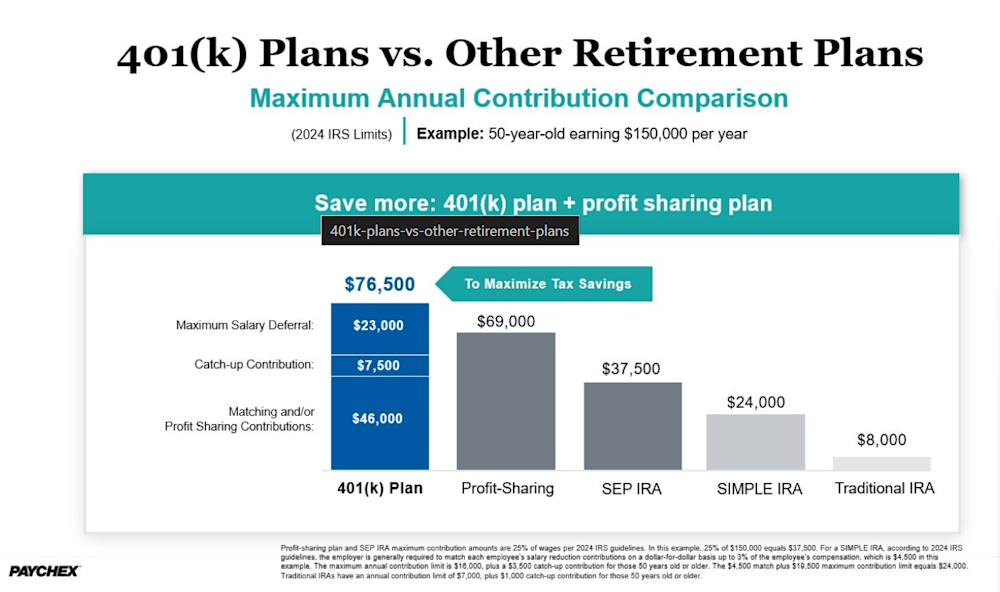

A 401(k) plan represents one of the most sound retirement options—with the ability to contribute more throughout the year than other plans. Consider the following example:

More Reasons Why 401(k) Makes Sense: Why a 401(k) is the Smart Choice for EVERYONE

Up to a $500 annual tax credit for 3 years for qualifying firms for establishing a plan

Profit Share component can be built in with options to maximize employer amounts

Low cost investment options to help to keep more of your savings

Emergency access via loans (optional)

Customized Choice of vesting schedules and eligibility options to address your firm's specific objectives

Allows both pretax and post-tax (ROTH) contributions, regardless of income

Protected from creditors in every state

To learn what this program can do for you:

Call 877.264.2615 to speak to a retirement specialist (Monday- Friday 8:00a.m.-8:00p.m. ET)

Complete this Online Form, and a specialist will contact you

**Small businesses establishing first-time retirement programs may be eligible to receive a tax credit of 50% for annual administrative costs, up to $5000, in each of the first three years of the program. Note: 100% of the employee salary deferrals are invested with 401(k) plans.